About Buttonwood Due Diligence

About Buttonwood

At Buttonwood, we view ourselves as a bridge, providing products and services in a way that connects industry stakeholders and improves the alternative investment experience for all. By refusing to be boxed in by a narrowly-defined purpose, we’re free to view the industry and its needs from a variety of perspectives. This broad viewpoint informs our business decisions and pushes us to continually innovate, enhance and improve our products and services to meet the needs of our clients.

Our History

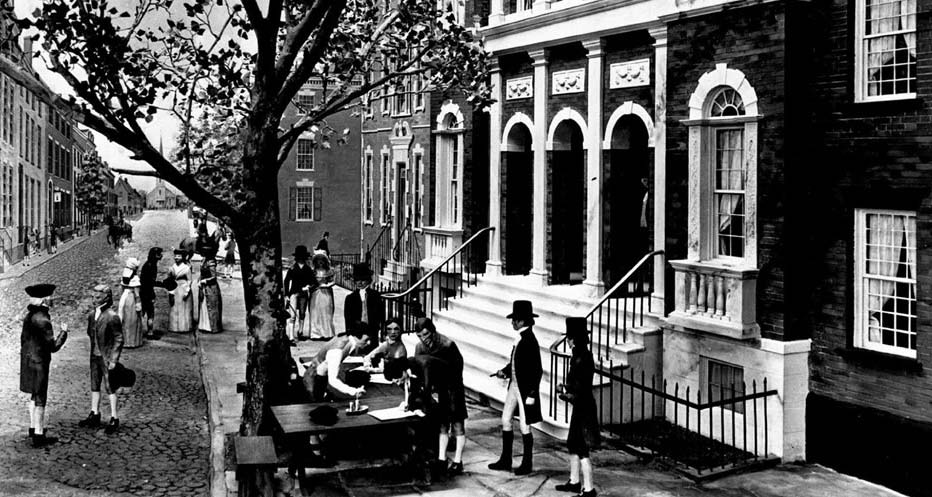

Buttonwood takes its name from the Buttonwood tree under which the agreement founding the New York Stock Exchange was signed. Buttonwood's founder, Dana Lawrence Woodbury’s, 4th great grandfather Augustine Hicks Lawrence was the youngest founding member under that famous buttonwood tree.

Management Team

Buttonwood’s analysts possess a wide range of capabilities and perspectives, have a combined decades of experience in the space and boast credentials including MBA, MA, JD, CPA, CAIA and more.

Due Diligence on the Due Diligence Provider

Buttonwood Due Diligence, as an independent third-party provider of due diligence services to the broker-dealer and registered investment advisor community, has implemented a Code of Ethics to strengthen Buttonwood’s endeavors to produce accurate, independent due diligence products and services.

- Buttonwood’s Code of Ethics sets forth policies and procedures with respect to:

- Maintaining independence

- Exercising diligence

- Maintaining confidentiality

- Prohibiting insider trading

- Adhering to securities laws

- This Code of Ethics prohibits the purchase by Buttonwood and its personnel of any securities offered by sponsors or programs that Buttonwood has reviewed or has been engaged to review as an independent third-party due diligence provider. Furthermore, Buttonwood will not market or promote any specific investment offering.

Background checks on Buttonwood management

- Being informed as to who you’re working with is vital, therefore it’s only fair that we turn the spotlight on ourselves. For background checks on Buttonwood’s management team, contact us here.

Frequently Asked Questions

First, Buttonwood’s Code of Ethics contains policies and procedures addressing and preventing various conflicts of interest, including provisions prohibiting any Buttonwood employee from accepting gifts, gratuities, or entertainment from any sponsor.

Second, Buttonwood is paid in full for any contracted services at the very start of an engagement, eliminating any financial leverage that a sponsor may have to influence the content of a Buttonwood Review.

Third, Buttonwood withholds conclusions from any drafts sent to sponsors, further reducing the sponsor’s ability or incentive to attempt to influence Buttonwood’s conclusions.

Fourth, when a report is finalized with our final thoughts, opinions and recommendations, the report is uploaded to Buttonwood’s Report Vault, a password-protected area of our website to which the sponsor does not have access. Click the link to visit the Report Vault.

Fifth, Buttonwood employees are prohibited from investing in any program previously reviewed or expected to be reviewed in the future.

Buttonwood employees are prohibited from investing in any program previously reviewed or expected to be reviewed in the future.

While every review is different, on average Buttonwood aims to complete each offering review within approximately 2 to 3 weeks and each sponsor review within approximately 3 to 4 weeks. Options are available to accelerate the review process when necessary.

Buttonwood’s due diligence reviews are tailored specifically to each engagement. Following discussions with management and/or an initial review of the primary offering document for an investment program Buttonwood will quote an engagement price that reflects and accounts for the anticipated complexity of the review in question. Please contact Buttonwood to receive a quote.

Our broad mix of talent and experience allows us to analyze an investment product or sponsor from financial, legal, operational and tax perspectives, all while asking the right questions and sharing our thoughts that are drawn from decades of diverse experience. Furthermore, we want all our clients to experience success. We pride ourselves on being fair and impartial and are here to support our financial advisory and sponsor clients in any way possible.